An Improvement but Canada still Lags the Pack: Canada Revenue Agency (CRA) Releases their 10th Annual Report on the Mutual Agreement Procedure (MAP) Program.

- The number of accepted negotiable MAP cases increased by 40 to a total of 127 during the year.

- The closing inventory increased by 13 for an ending inventory of 235 which resulted in 114 MAP cases completed during the year. There was an increase of 17 negotiated MAP cases from the prior year.

- The average time to complete MAP cases also decreased on average. Canadian initiated MAP cases decreased to 26 months from 31 months compared to last year, but Foreign-initiated MAP cases increased in completion time from 20 to 22 months.

Similar to last year, the CRA did not reveal any details regarding the results of MAP cases that went to mandatory arbitration between Canada and the United States. It is widely believed that one benefit of mandatory arbitration is the decrease of completion time for Canada-US negotiated cases.

There were no material changes in the type of transfer pricing methods or profit level indicators used as the basis to resolve cases when compared to other annual reports. There were 7 instances where no correlative relief was granted. One case was due to the filing being outside the time of limitations, another case was due to the taxpayer concurring with the appeals branch, two cases were not covered under a specific income tax convention, two cases were the result of uncooperative taxpayers, and one case of no relief was due to residency issues.

MAP Terminology and Background:

The Organisation for Economic Co-operation and Development (OECD) Model Tax Convention on Income and on Capital recommends that bilateral tax conventions include a section (article) on mechanisms to resolve disputes, generally referred to as a Mutual Agreement Procedure (MAP). Dispute resolution articles generally address, amongst other things, cases of double tax arising from a transfer pricing reassessment. In Canada, the Minister of National Revenue authorizes senior officials within the CRA to endeavor on his behalf to resolve a tax dispute under a tax convention.

Negotiable MAP cases are differentiated from non-negotiable MAP cases. A non-negotiable MAP case would not require negotiation with other tax administration.

How has Canada performed compared to other OECD member countries?

In late August, the OECD has released 2012 MAP statistics of all its member countries and partner economies that agree to provide such statistics Of the 34 OECD member countries that have reported MAP caseload, Canada had the 6th highest closing inventory. The complete list, in order of ending negotiable MAP inventory for 2012 is as follows:

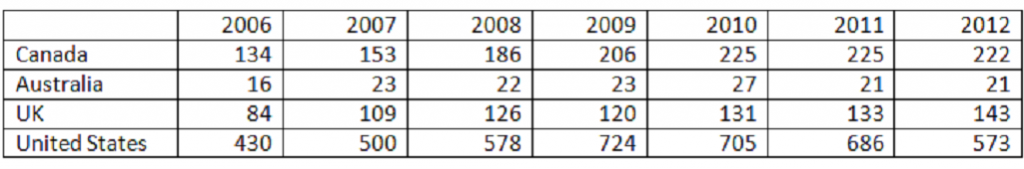

Canada is one of the more active countries that uses MAP to resolve double tax resulting from transfer pricing reassessments. This activity becomes evident when we compare Canada to the US, Australia and the UK on their respective activity of the MAP program.

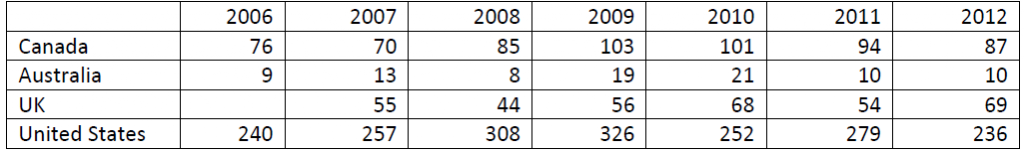

New Negotiable MAP Cases Initiated by Year:

Negotiable MAP End of Year Inventory Caseload:

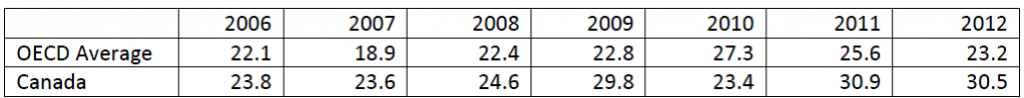

The time for completion of a MAP case still remains high compared to the OECD average. The table below compares Canada’s average time of completion per year compared to the OECD average when negotiating with other OECD member countries, measured by months.